Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Token Economics Best Practices, pt. 1

At Arcanum Ventures, we’re actively seeking investments in promising projects, which means we review a lot of slide decks, whitepapers, and pitches. Many times, these projects leverage token sale models as streamlined methods for fundraising, allowing their teams to secure their runways easier and at a better valuation than going the traditional tech startup route.

Many of their products could function just as well without incorporating a cryptocurrency or Decentralized Ledger Technology (DLT). But the truth is, these two ideas are not mutually exclusive. It’s important for founding teams to do what is in their best interest to develop the products they believe will bring real-world value and help address existing issues in a number of industries.

In this specific and more frequent case, the primary utility of the token economy should be to somehow funnel value back into the ecosystem from any revenue generation, exclusivity, access gained, etc. by the product itself. The concept itself is simple, but the execution seems to be a bit trickier. Especially considering, there are several “best practices” to follow when designing and launching your cryptocurrency and token economy. Here are a few to get you started:

1. Token Organization is a Must

Every token sale model depicts a series of buckets or tranches that tokens are allocated to. This is typically split up between internal tranches by function, such as: operations, marketing, development, community incentives, etc. This is also typically split up by external tranches as well: Seed Round investors, Private A Round Investors, Team, Advisors, etc.

After your initial token mint, be sure to distribute your supply into separate smart contracts and wallets corresponding to these token tranche designations. You can even designate names and identities to each smart contract or holding wallet. I highly recommend coding your smart contracts to vest these tokens specifically according to the vesting schedule for each token tranche that you marketed to your early investors and the public.

This creates transparency and promotes accountability, helping your backers and retail investors understand that you are being fiscally responsible, and that their potential investment is far less prone to an internal vulnerability or a rug-pull.

Even better, this will help your financial team understand the designation and reserve allocated to each internal function, making balancing the books and settling transactions much easier.

2. Respect the Vesting Schedules

This is one of the primary metrics your early investors will evaluate your project by. It is an essential part of the terms that dictate exactly what they are purchasing from you and when they are receiving it.

It may sound counter-intuitive or absurd, but many projects have broken contracts, violating terms in their SAFTs and investment agreements by involuntarily locking up vested tokens for longer periods of time. This happens particularly often during market downturns where founders are shocked to witness such heavy sell pressure forced by early investors.

It should come as no surprise that your vesting schedule can be thought of as a prescribed dumping schedule. Ensure you’re comfortable with the vesting terms you are creating and STICK TO THEM. If you encounter trouble fundraising due to conservative vesting terms, then you’re pursuing the wrong investors.

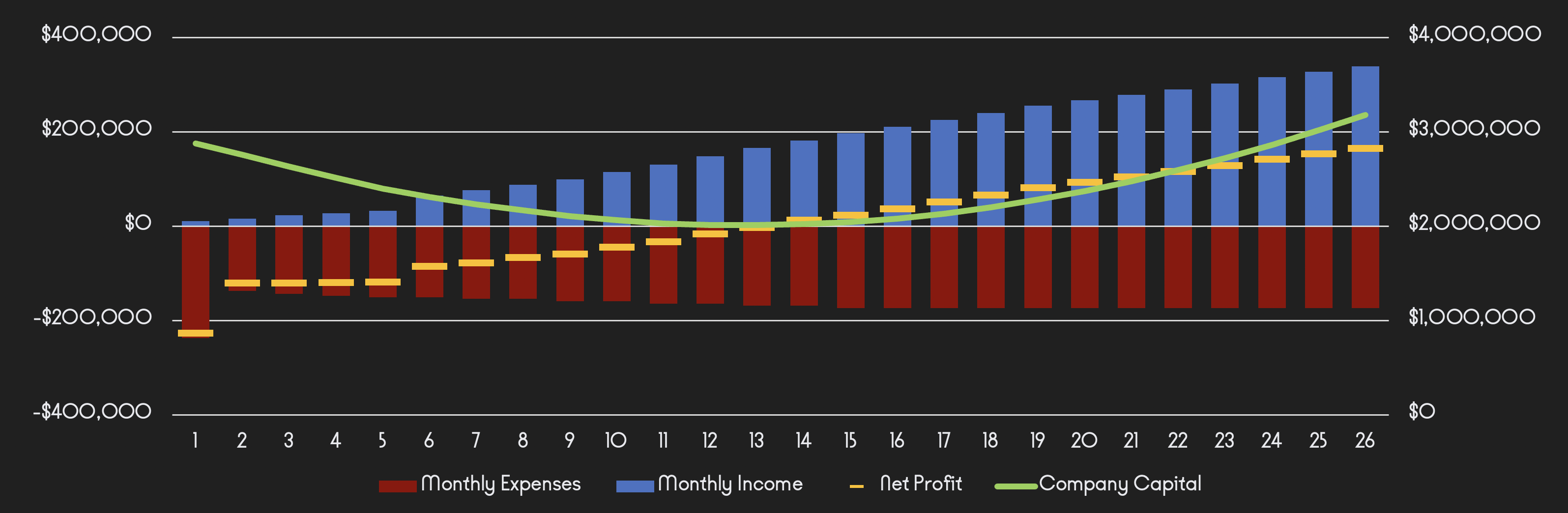

3. Budgeting Shows Planning

Our Fundamental Analysis process at Arcanum Ventures is extremely critical. We like to check every box before moving forward, so we focus on both big and little things. It helps give us insight into how a team functions and performs.

The success of a tech startup may hinge on the level of preparation and planning the founding team performs. This includes planning on every front such as: structuring the organization’s hierarchy, competitor marketing analysis, viability analysis, business development strategy, and financial planning.

It’s important to be realistic with the capital your startup needs and to understand where this capital will be used, how, and how quickly (ie. burn rate).

We often see startups that don’t put in the necessary amount of work to fully understand what their budgetary needs are. It’s not uncommon to hear “we want to raise as much money as we can.” I get the impression of financial irresponsibility and a low likelihood of execution with no clear funding target.

Even worse, this tells me and other investors that the team will likely rely on heavy token supply liquidations in the event of a funding squeeze, devaluing my equity stake in the company.

Help your investors understand what your development, operations, and marketing capital requirements are. Draft out a 5-year budget that incorporates future product development, ecosystem expansion, and onboarding for business development efforts. And then show me your treasury management strategy for the next 5 years.

3-Year Revenue and Capital Projections for a Tech Startup

My own rule of thumb is to target your fundraise for the capital requirements needed to develop your Minimum Viable Product (MVP) and initial onboarding for Business Development, in addition to a small buffer. This ensures you have the capital you need to get your business to the revenue generation stage. Then be responsible with your token liquidations since this will negatively impact your early investors. After all, they helped you get there.

Arcanum Can Help

We offer comprehensive token economics services and financial modeling & planning to help your startup plan for the worst.

Our goal is to give you the tools and services you need to maximize the viability and longevity of your cryptocurrency startup. We believe in backing projects that will address real issues in various industries and leverage blockchain technology to improve current systems.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

May 14, 2024

“Accessible, Transparent, Equitable”. Beyond the homepage and the navigation links, the ReformDAO whitepaper…

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…