Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Audit Your Tokenomics With Arcanum Ventures

Progress has been slow. Slower than you would expect. Many of the critical discussions around tokenomics seem to be happening in closed circles. Thought leaders cautiously trickle ideas out, gauging the sentiment around fractals of concepts before implementing them in their designs.

The public discussion has intensified in comparison. Although different, the basic message saturating social media channels is no less important:

“Tokenomics is not what you think it is. It’s not what YouTubers talk about. It’s not what investors beeline for. It’s not a pie chart – it’s not a vesting schedule. Tokenomics is much greater than that.”

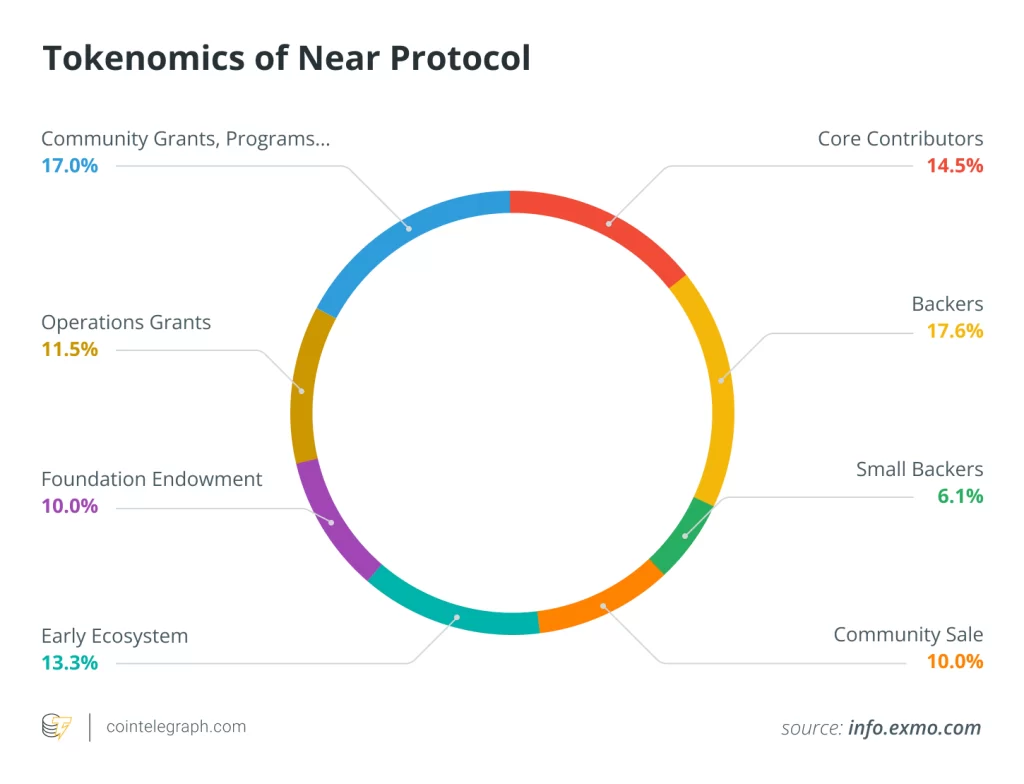

Figure 1: CoinTelegraph denotes a token distribution pie chart as “tokenomics”

This lack of understanding remains entrenched not only in investment circles but among Web3 startup teams as well. Arcanum Ventures continues to live through discussions with cryptocurrency founders who claim to have well-rounded token economies, only to showcase a distribution and token fundraising model.

To put it simply, Arcanum Ventures defines tokenomics as the overall Protocol Design where a digital asset and its distribution are integrated into a product, user experience, business model, and financial strategy. This means that every new crypto startup on a two-month, bull run, token launch trajectory is underestimating the risks.

If the token fails, everything fails with it. The product, the user experience, the community, the finances, and ultimately – the company.

The Perils of Runaway Inflation

Symptoms of a poor economy are few and common, making it difficult for even company founders to pinpoint the root cause of a failure. What’s often seen are hallmarks that span across multiple core business areas:

- Slow to no user traction

- Volatility of digital assets portfolio

- Asset devaluation caused by rapid inflation

- Excessive sell-pressure, diminishing liquidity, and failing token price

The commonality of these symptoms across poor marketing strategies, business development progress, or financial management makes it confusing for any outsider looking in. Many misinformed individuals point to tokenomics as the scapegoat.

Unfortunately, they’re partially right. Strong economy design can mitigate many risks introduced by slow business growth, up-and-down marketing, poor community management, suspicious treasury management, etc.

Common Issues in Token Economies

Here are the seven most common issues every token economy design should seek to address:

1. Lack of Product Focus: Prioritizing fundraising over product development and user experience can lead to a misalignment of economic incentives

2. Overcomplicated Economics: Complex models with multiple unnecessary assets can confuse users and hinder adoption

3. Lack of Viable Utility: Tokens without clear utility struggle to gain user adoption

4. Regulatory Concerns: Navigating the regulatory landscape is a constant challenge – “essential” token use cases that live in the grey area pose major risks for the product

5. Security Concerns: Vulnerabilities introduced by novel designs may intimidate both users and investors who were previously victims of protocol breaches and hacks

6. Token Distribution Issues: An uneven distribution can lead to an imbalance in token control, liquidation power, governance, and centralization

7. Sustainability and Scalability Risks: Emissions mechanisms and value faucets that aren’t offset by positive net value or contribution can cause runaway inflation

Elevate Your Design with Our Token Economy Audit

Arcanum Ventures brings the uncommon investor perspective into evaluating economy designs. This allows us to understand better how to prioritize what’s important in token economies that parallel promising technologies.

We offer comprehensive auditing services to evaluate all of these core aspects of your economy. Our reports offer insights for improvements and actionable recommendations to strengthen your business and outlive your competitors.

Our audits focus on the following:

- Token Sale Model and Distribution: Analysis of the token distribution identifies misalignment between tranches and business functions. Additionally, mapping stakeholder control and influence helps highlight risks around the token launch event.

- Economy Design: The focus remains on product-market fit and the philosophy of human-centered design, evaluating how your token’s utility aligns with real-world needs that can more easily foster demand.

- Value Accrual and Demand: Analyzing how value accrues within the ecosystem tells us how a viable utility lines up with sustainable tokenomics and the financial health of the company.

- Ecosystem Interactions: An agent-based approach verifies product and feature alignment but, more importantly, identifies potential conflicts of interest that can introduce risks and imbalances.

- Revenue Analysis: Longevity is the goal, and analyzing revenue streams helps rank scalability and vulnerability to factors outside of company control.

Take Action for a Bulletproof Token Economy

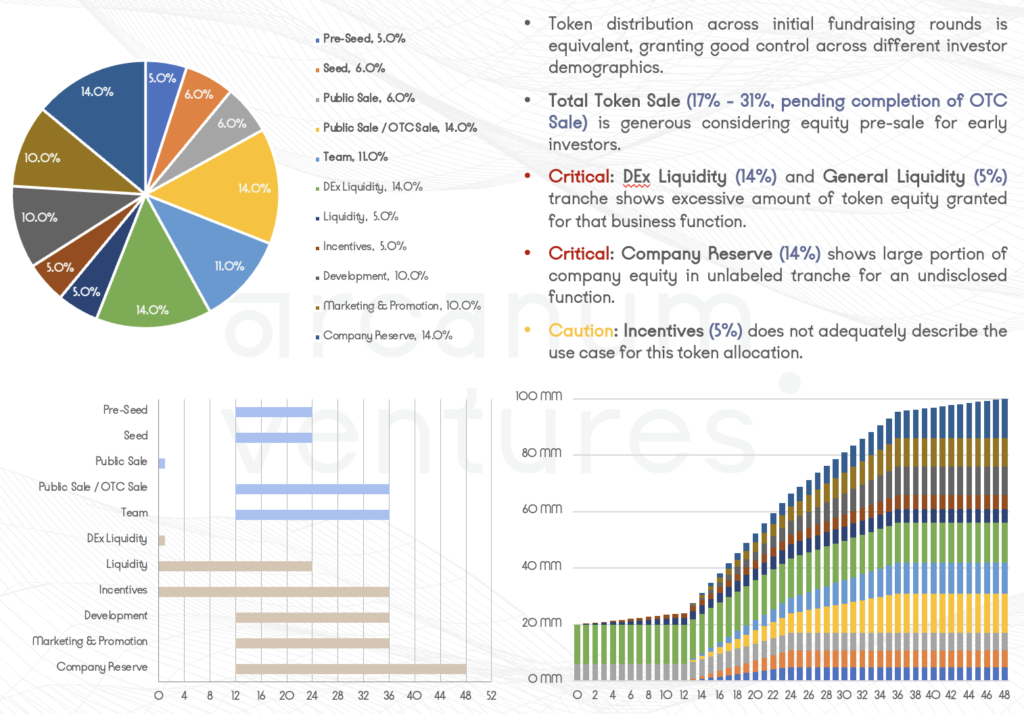

An example audit report can be downloaded below the example image. This particular report was created for a Web3 talent marketplace that utilizes a digital asset economy to promote healthy interaction between industry professionals and companies looking to hire.

Figure 3: Our audits cover token distribution, utility, value accrual, and other essential focus areas of your economy

Don’t cut corners on your digital asset economy. Arcanum Ventures’ audit can help improve your design, strengthen your business model, and identify any risks you may be missing.

Whether you need an audit for your token economy or a comprehensive and bespoke build, reach out to discuss how Arcanum Ventures can help.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…

April 4, 2024

Arcanum Ventures is pleased to announce our latest strategic investment in Analog, a novel ‘Proof-of-Time’…