Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Phasing Out a Web3 Token Economy

“The majority of token startups can exist without a token.”

This was once the most controversial statement someone could make in this industry, quickly drawing ire and looks from web3 founders who then mentally blackballed the offender. Still today, in many circles, this can trigger crypto veterans who have been around to see several cycles of speculation, manipulation, and deception.

The reasoning is simple – as most, if not all of us are somehow connected to a cryptocurrency startup that touted a loose justification to create a digital asset.

Transition In, Transition Out

The Arcanum Ventures team has been vocal about token use cases before, and like any good visionaries, we refer back to our core pillars often – relentlessly pursuing the concepts of decentralization, fairness, and meritocracies. Still, we don’t wholeheartedly disagree with token utilities that are considered “non-essential.” We’ve been just as vocal about the importance of founder resourcefulness, where Web3 startups can demonstrate the ability to think outside of the box to achieve their milestones.

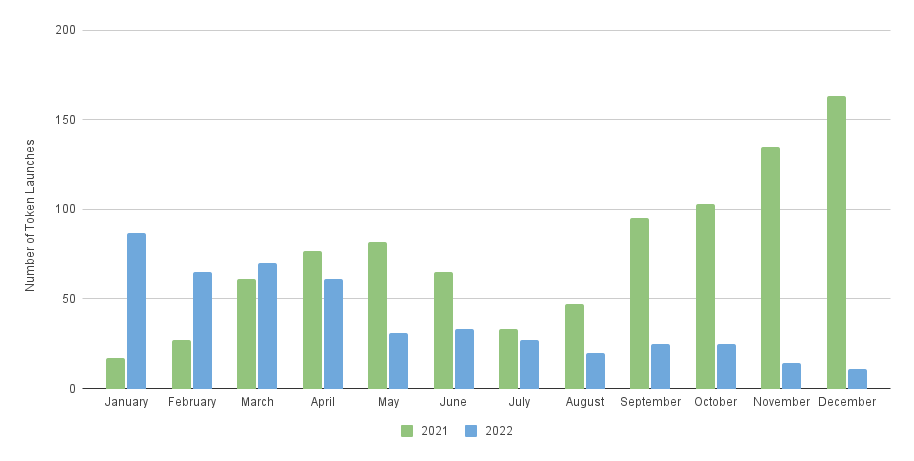

Figure 1: 2021 saw dozens of token launches weekly while founders rushed to raised funds

In some cases, this means conceptualizing, designing, and launching a cryptocurrency to better fundraise. In one of our earlier articles, the concept around Primary Token Utilities was introduced, meaning any token use case that is integrated into the functionality of a platform or protocol.

Two examples that quickly come to mind: (1) DAOs where a token supply dictates voting rights and power or (2) crowdsourced labor or consensus to achieve a common goal.

Although many crypto startups came to market over the past few years lacking a single Primary Utility, they have demonstrated resourcefulness in reaching fundraising targets, building products, and growing their companies.

The token may have served to achieve these startup goals for the company, but there may be a period where the token no longer serves a primary purpose. Even with tokens that hold primary utilities and are essential to the company’s development, there may be a phase in the cycle where keeping the token may be unnecessary and may hurt the user experience.

In the context of a company’s long-term horizon in pursuing a merger or acquisition or going public through an IPO, the token may pose a regulatory hurdle. Cases where widespread access to decentralized assets with convoluted utilities are often stricken down by many regulators.

The message is simple, there may be a time when the team must sunset the token.

Real Examples

The idea of a primary utility no longer being necessary sounds counterintuitive, however, companies evolve and different phases require pivots.

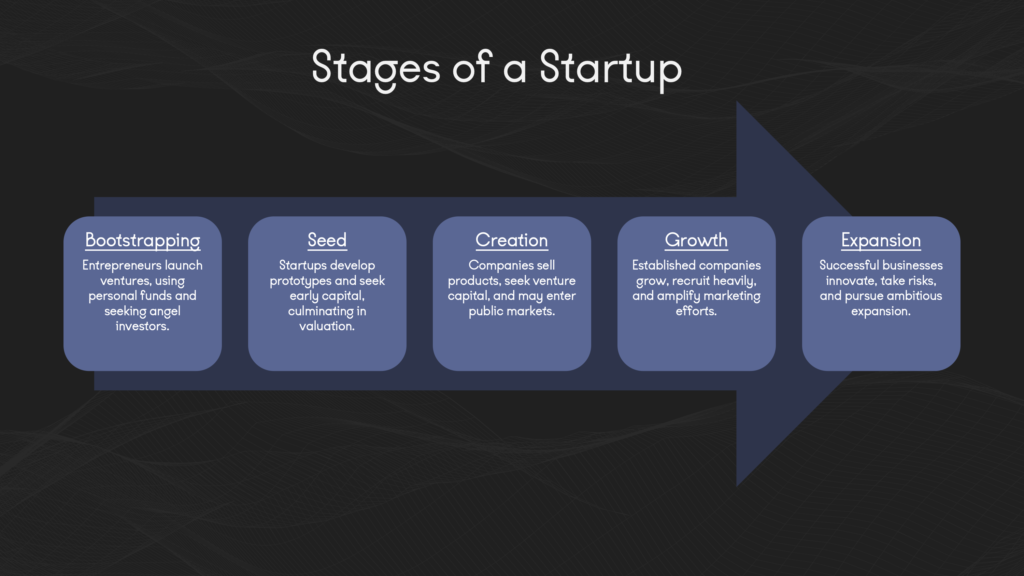

A general startup will require initial bootstrapping and funding, where a token may be used to more efficiently onboard investor capital. Later, the token may be used to help develop and grow the product.

Figure 2: The stages of a startup cycle

At Arcanum Ventures, we are actively exploring the best avenue for our clients to build their companies, grow, and achieve success.

In several cases, we must understand how to pursue best-case scenarios that rely on decentralization in a single stage. An international telecommunications diagnostics network, for example, relies on quickly creating a network of nodes across the globe so they can pursue B2B clients for service provisioning. The development of this network is far more resource-intensive in the first 24 months than in the following maintenance stage.

Figure 3: Helium, a wifi node bootstrapped expansion before encountering heavy inflation with no value accrual

Another client crowdsourcing feedback and information to help train their community-based artificial intelligence moderator requires large amounts of input and data in the first year. This load may significantly drop as the team sees an inverse exponential increase in effectiveness as the model improves and they can launch the product to pursue revenue. Suddenly, user input is not as critical, but the token still exists. What do they do?

The direction is simple, a company must do what makes sense for both its business and its users.

The To-Do-List

Taking care of token stakeholders is important, especially considering they helped support your business in the creation and growth stages.

This can be done by clearly understanding what value they can expect to receive for their support, painted by the company’s marketing and community development strategy.

Some stakeholders may understand that the token serves as an avenue for the team to develop an impactful product that they may one day use. Many others will expect that the token offers an investment opportunity whose viability is tied loosely to company performance.

In both cases, some value is expected in return, although two primary avenues exist in the conversion process: (1) allow token holders to be converted into platform users, (2) and in most cases, convert token holders to non-token holders

Here are some high-level points to implement in strategizing:

- Prioritize token stakeholders within reason

- Understand avenues for granting them value

- Balance these avenues with the company’s financial priorities

- Create a reasonable exit strategy for your stakeholders

- Allow options

- Clarify milestones for success

In most cases, the process to sunset a token will likely mean eliminating it from the market. This result can most simply be achieved through a company-mandated token buyback program. Traditional financial instruments can offer some good inspiration.

Exit Options

A. The Dynamic Token Put Warrant

The Investopedia definition describes a Put Warrant as “a type of financial instrument that grants the holder the right, but not the obligation to sell a given quantity of an underlying asset.”

Including a Put Warrant clause in your investor agreement can allow an easy exit for early financial backers that hold some residual token equity. This clause can be triggered based on a very tangible milestone such as: entering the contractual phase for a merger, acquisition, or IPO. Justification for initiating the token buyback comes from the need for the company to button up its finances to adhere to regulatory requirements.

As the Put Warrant is validated, investors are granted the right to sell back their tokens to the company. Asset pricing for the execution of this transaction may be predetermined based on some premium to the token sale price offered to a particular investor. Otherwise, the agreement and clause may include dynamic pricing based on a discount from market value, however, the are better options to consider, pun intended.

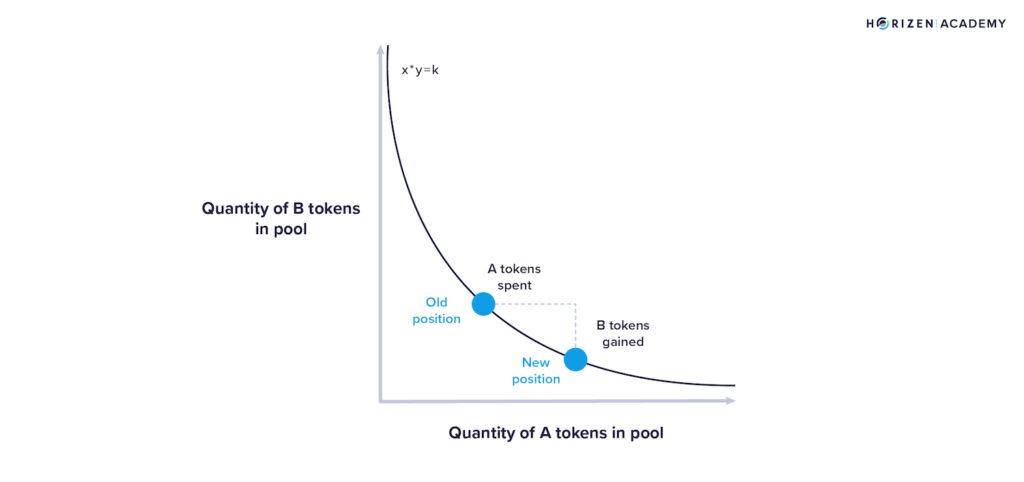

The automated market maker lays out potentially vicious market conditions in the event the team decides to sunset the token. In this event, we understand that the obsolete token will be implied to be unnecessary and untethered to the company. This means the only extractable value that remains is the value backing in liquidity pools across both centralized and decentralized exchanges.

Figure 4: Automated Market Makers calculate buy and sell price based on liquidity of pairing

Token holders may be forced to compete in a race to the bottom of the liquidity pools, which likely do not hold a 1:1 value backing for the entire market cap of the token. Token holders will get far less value than they expect, and many of them will take large losses,

This allows the company to offer a buyout option pegged below the market value of the token, meaning token holders will, unfortunately, get less than they anticipated based on the market cap of the token supply, but are guaranteed some value versus potentially being muscled out and manipulated by each other across exchanges.

B. The Inverse Token Call Option

Speaking of options, additional inspiration can be taken from the derivatives market. Aside from a put warrant clause, an investor contract may be structured with a Call Warrant that designates the investor as the warrant writer or seller, giving them the obligation to sell the underlying asset at a particular price.

Although the end result remains the same, there may be some investor sentiment negatively associated with obligations for a sell-back.

C. Token Equity Convertible Warrants

Lastly, there may be an avenue to convert major, early financial backers into equity holders of the company. With careful evaluation of investors and VCs that are onboarded, it may be good to consider granting these investors equity exposure.

This article by Jamie Goldstein outlines a Token Equity Convertible instrument implemented by Pillar VC in 2017. The instrument includes clauses that can be validated through specific metrics, such as “all original token holdings must be retained until the company enters negotiations for a merger or acquisition.

Structuring a strategy with multiple avenues can allow these early investors the option to exit with their token holdings or convert to equity, especially if they initially were interested in this option in their due diligence.

An Example Process

1. Contract Phase: Understanding what types of contractual clauses to include in the investor agreement will depend on a few factors. These are all novel concepts and will require bespoke evaluation and structuring with the help of legal professionals. It’s also important to consider the types of investors your company may pursue and their familiarity with the concepts behind these traditional financial instruments.

2. Projections and Modeling: Employing an experienced token economist and financial professional is important to structure a sound strategy for your token exit. A full-supply, token buyback will affect your company’s finances and clauses should not be validated without a strong financial foundation.

3. Communication: Clear and honest communication with investors is important. Help them understand that the long-term trajectory of the company may include pursuing a merger or acquisition, or going public. In any case, there may be a necessity to sunset the token economy, at which point the company will ensure investors still holding tokens are taken care of through the following process.

4. Initiation: Don’t jump the gun! Eliminating a token from existence is a major company pivot out of Web3. Additionally, it’s important to ensure company infrastructure and user experience will not be compromised by eliminating the token economy, otherwise, the markets may determine the future of your company looks bleak.

5. Implementation: Different strategies will be required for both pre-sale and retail token investors. While pre-sale investor execution will be critical for compliance, since these clauses may parallel traditional finance securities, retail investors must be taken care of as well. A well-communicated buyback deadline paired with on-chain data analytics can ensure all retail investors are offered a fair exit.

Closing the Curtain

There’s no shame in putting a token out to pasture. In fact, this may be the best way forward for your business as it moves into the growth and scaling stages.

A Web3 exit can be done in several ways, but here we offer some options that take inspiration from traditional finance (TradFi) that can be used in creative ways to create a win-win scenario for all stakeholders.

In a coming article, Arcanum Ventures will discuss an innovative token economy design to eliminate the need to create a compliant Web3 exit for early investors. The article will discuss a novel mechanism for isolating investors and product users regardless of different incentives.

If this content interests you, be sure to follow Arcanum Ventures on our social media channels. If you have questions about your company’s token economics, we encourage you to reach out and speak with the Arcanum Ventures team to help structure your company’s digital asset economy.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…

April 4, 2024

Arcanum Ventures is pleased to announce our latest strategic investment in Analog, a novel ‘Proof-of-Time’…