Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

What are Tokenomics and Why Do They Matter?

In the burgeoning world of blockchain and cryptocurrency, one term you’ve likely encountered is “tokenomics,” a portmanteau of “token” and “economics.” These two terms can be used interchangeably although some debate exists about the differences in terminology.

So you might be wondering what exactly tokenomics entail, and why it is so crucial for the success of web3-integrated projects or blockchain startups.

At Arcanum Ventures, we dive deep into the intricacies of tokenomics, aiming to demystify its concepts for beginners and clarify common misconceptions for industry veterans.

What Does Tokenomics Mean?

Ever since the mysterious “Satoshi Nakamoto” unveiled the Bitcoin whitepaper back in October of 2008, the advent of the world’s first blockchain and cryptocurrency has given rise to a disruptive and promising industry.

Despite being over a decade and a half removed from the launching of Bitcoin, individuals working in the nascent blockchain industry still struggle to fully understand the principles of token economics.

Tokenomics encompasses the economic model and incentives within a blockchain or cryptocurrency ecosystem that make a token valuable and useful. It is important that a digital asset, and its overarching economic system should provide value for all stakeholders and economic participants, from early inventors to protocol users of all types.

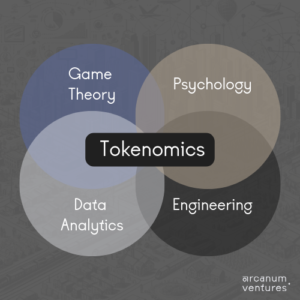

The holistic token economy, for better or worse, serves as the backbone of any crypto startup, influencing everything from the token’s distribution and supply mechanisms to its utility and governance. A truly exceptional tokenomic architecture incorporates principles spread across a vast set of fields and scientific disciplines, such as game theory, traditional economics, behavioral economics, psychology, engineering, and more.

Effective tokenomics design ensures a cryptocurrency not only thrives but sustains its growth and utility over time. Poorly contrived token economic designs can tarnish the reputation of even the most successful companies and harm key revenue streams.

Key Pillars of a Token Economy

To effectively build a comprehensive token economics system for a blockchain startup, one must consider the following pillars:

Supply Management

Depending on the complexity of an economy and the purpose it is serving, a token supply and management strategy can come in nearly any shape or size. How many tokens are available at launch? How many tokens are created in total? What are the tokens used for and how are they divided into tranches for different key purposes? How is their supply controlled over time?

Distribution Mechanisms

How are tokens distributed initially to investors, advisors, team members, and key stakeholders? Most in the web3 industry focus on the initial vesting of tokens and how they are transferred from a company or smart contract control over to the hands of users and investors. One must also consider how these tokens circulate throughout the economy and serve different stakeholders. Aligning incentives and maintaining a harmonious homeostasis is crucial for a token’s and subsequently a web3 startup’s success.

Product & Protocol Mapping

A successful web3 startup likely offers useful services, platforms, or other products to improve the experience of its users in one way or another.

Most web3 startups seem to miss the mark on actual product design, placing a heavy focus on profit without considering the experience of the end user. By mapping out the entire product ecosystem of a startup and working closely with the development team, the token can be integrated into all offerings in a variety of ways, including new product and protocol ideas that help improve the customer experience while helping the token accrue further value.

Business Strategy and Financial Modelling

For all the capital being raised in the crypto startup sector, there is an unsettling lack of emphasis placed on long-term business strategy and financial forecasting. Numbers are pulled from thin air, and there seems to be little connection between how a company in web3 makes money, how it transfers value to token holders, or how it plans to maintain its standing as a functional and profitable company well into the future.

A token or digital asset is not the central feature or product of a web3 startup, or at least it shouldn’t be.

Token Utility

Perhaps the most overlooked aspect of token economic design in the web3 sector is the actual utility of the token itself. Why should investors want to purchase tokens, even at early, discounted prices when the token serves no purpose in an overarching economy?

What can holders do with the tokens? Why would they continue to hold the token long-term? How can utility help a token accrue value? Utilities can come in all different types, including governance, staking, payments, burning, and access to specific features within the ecosystem among other things.

Aside from the actual technical development side of a token design and the blockchain infrastructure needed to create and maintain a digital asset, there are many other notable attributes needed to create a truly holistic token economy

Unfortunately, the lack of education or understanding surrounding the key principles of proper token economic design in web3 helps perpetuate half-baked utility tokens that crater in value and harm the reputation of even the most well-meaning founders.

Common Misconceptions about Tokenomics

Despite the integral role tokenomics play, they are woefully misunderstood by even the most savvy and experienced blockchain veterans.

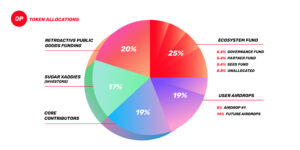

Some believe it’s solely about how tokens are distributed or assume it’s an easy process that involves merely creating a token supply and sending it out according to a vesting schedule.

Token economics are not a vesting schedule, a pie chart, or a quickly-produced infographic. This smaller subset of tokenomics can be described as token metrics, or key information for investors to learn about the supply, vesting, cliffs, and other key aspects of a token supply across multiple investment rounds.

They are much more complex and nuanced, needed to balance incentives and ensure long-term viability for a token and its corresponding startup. Poorly designed tokenomics can lead to inflation, loss of value, plunging investor sentiment, and even project failure in extreme circumstances.

The Importance of Expertise in Tokenomics Design

If economic incentives are not aligned with a web3 startup’s goals, it can lead to disinterest and disengagement from the community. Furthermore, inventors can pull out if they perceive the tokenomics to be unsustainable without a clear path to value creation for early backers.

Designing effective tokenomics is no task for amateurs. It requires a deep understanding of economic principles, blockchain technology, and market dynamics.

Expert guidance is indispensable in this particular area, especially in such a novel field that is constantly evolving. You wouldn’t build a house without an architect’s guidance. Building a digital asset economy for a web3 startup without the help of a token economics designer is perhaps even more ill-advised!

Why Choose Arcanum Ventures for Tokenomics Design?

Arcanum Ventures stands apart in the crowded space of advisory services. Unlike others, we commit to the indefinite success of our clients, viewing each project’s success as our own. Our approach goes beyond superficial token launch models, delving into the full examination of economic agents and users, the user experience, revenue streams, financial forecasting, products and features, and so much more.

Tokenomics is the linchpin of any successful crypto startup looking to launch a digital asset. Understanding and implementing effective tokenomics is not a mere step in project development—it’s a fundamental aspect that can determine its fate.

Arcanum Ventures prides itself on navigating these complex waters, ensuring your project not only launches successfully but thrives in the competitive crypto landscape. For those looking to make their mark, remember: the right tokenomics design can set you apart.

To work with Arcanum Ventures on your token economic system design, feel free to apply for a free consultation here.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…

April 4, 2024

Arcanum Ventures is pleased to announce our latest strategic investment in Analog, a novel ‘Proof-of-Time’…