Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Crypto Fundamentals: Arcanum’s Overview

Any YouTube search query containing the word “crypto” is usually met by a million videos sporting open-mouthed, shocked faces in front of red and green candlestick charts. Unfortunately, “trading” and “investing” have become conflated through the rapid spread of this get-rich-quick media. Many seem to have trouble differentiating the two.

Cryptocurrency’s popularity in mainstream media began in early 2021 through many influencers. These gatekeepers came to fame through sheer consistency and manipulation of social media platform algorithms. Some of the biggest names in the industry offer hopes of massive investment or trading returns through cryptocurrency Technical Analysis.

Collection of “Shocked-Face” YouTuber Thumbnails

Collection of “Shocked-Face” YouTuber Thumbnails

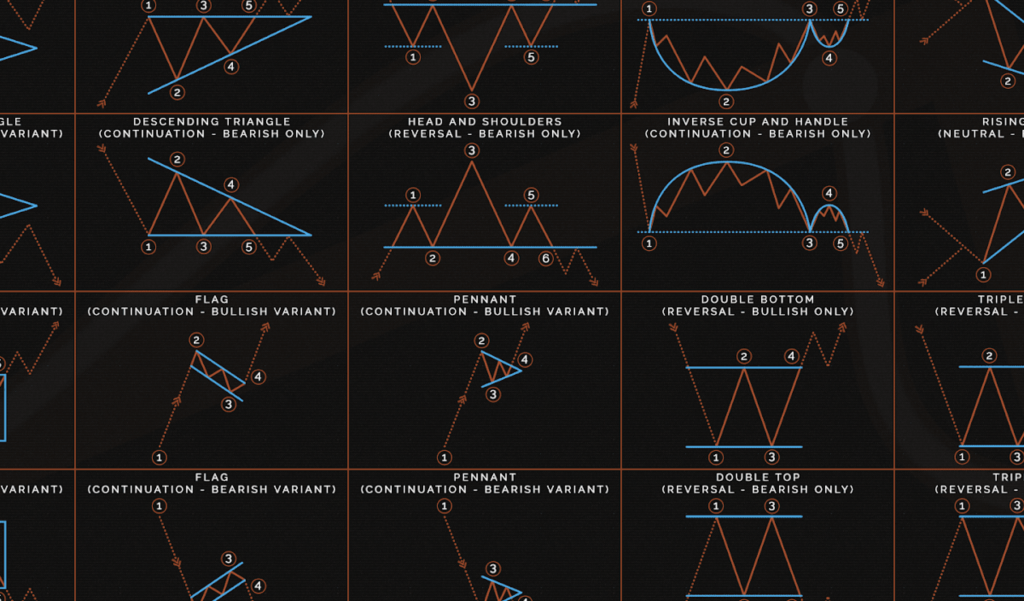

Technical analysis refers simply to charts and graphs, and nothing more. The practice of examining data that charts the price, volume, and various other metrics of a particular asset that is traded on an open market. Analysts predict price movements based on what they see in the charts.

Technical analysis is solely a trading philosophy. It takes into consideration a number of factors, including price jumps and rebounds, market psychology, and inflection points predicted by momentum shifts. Although the “technicals” can be effective and have historically been effective for many traders, there are inherent flaws when applying them to investing and, sometimes, to cryptocurrencies in general.

For one, none of these metrics take into consideration company health, operational activity, and the business or product itself.

Technical Analysis Chart Patterns – Image courtesy of Tradespine

Why are Fundamentals Important?

Fundamentals collectively refer to all information and data outside of asset price movements and similar indicators that may hint at short-term price migration. These sets of information or tools allow investors to attach a valuation to an asset or a direction of asset price movement based on whether it is believed or perceived to be overvalued or undervalued.

The Fundamentals take into consideration all of the logistical and business aspects of the overarching asset. For this reason, fundamental analysis is the cornerstone of investing and understanding the health of a business.

It can further be broken up into Quantitative Fundamentals, which take into consideration all metrics found on a balance sheet, or Qualitative Fundamentals, which require an operational and economic understanding of the business and its landscape. The latter plays a bigger role in a cryptocurrency startup evaluation, considering these young businesses rarely have enough traction or history to determine business health or direction from a balance sheet.

Qualitative analysis may include a look at a company’s resources, such as people and their experience, intellectual property, or assets, that may help them reach their business goals more effectively. It may also include an analysis of various competitors and comparisons between the business’s product or service advantages versus others on the market.

Differences between Quantitative and Qualitative Fundamental Analysis

Differences between Quantitative and Qualitative Fundamental Analysis

All of these bits of information help transition the “gamble” towards a “sure thing,” although nothing is guaranteed in investing. Making a decision to long or short a stock without performing any research essentially gives you a 50:50 chance of success. With every bit of information and research an investor digests, their understanding and resulting confidence in their decision may shift from 50% to 52%, then 58%, then 64%, then 71%.

A casino with a 71% chance of winning is a casino worth living in.

One important distinction between investor confidence and investor assurance is the quality of the fundamental analysis performed and how close an investor’s understanding is to the truth.

It’s important to constantly learn different research methods, apply new strategies, and communicate with other investors to share lessons. Otherwise, research techniques can become flawed or outdated, resulting in poor investment decisions.

How Are Fundamentals Different in Web3?

There is a multitude of differences between the cryptocurrency investment space and “TradFi” referring to stocks, securities, derivatives, etc. The most significant is the difference in speculation velocity and momentum that comes with a startup landscape. Many cryptocurrency companies are still in the early startup stages, having recently established a business and still building their products or services.

For this reason, it’s important to “Do-You-Own-Research”, or DYOR. The speculative nature of this industry offers many opportunities for content creators, loudmouths, and investors to shift narratives and manipulate a reactionary public.

Pay close attention to information that is clearly made public by the company itself, and don’t trust any information shared between individuals or organizations that is not endorsed by the company. This information may be tied to attempts at market manipulation, which is commonplace in an industry still lacking any regulation or authoritative oversight.

What Are The Fundamentals?

Arcanum Ventures uses a multi-stage, qualitative fundamental analysis approach to investment opportunities. Our goal is to efficiently filter out companies that do not align with our investment ethos, companies that fail to understand proper product-market fit, and companies that fail to demonstrate resourcefulness in acquiring the tools needed for long-term success.

Here are some of the areas our analysis focuses on:

Business Viability

The underlying technology of blockchain and the benefits it can offer through distributed systems may address a number of existing gaps in various industries. One of our greatest green flags is a company’s grasp on what problem they are focusing on that can be addressed by blockchain technology and the understanding of the business moves it takes to get there.

Token Economy and Finances

There must be adequate clarity on the asset being sold to investors. Many startups offer a token that may not be essential to the product or service functionality. Many investors throw money in regardless. It’s important to understand how the asset will reflect business health and appreciate with greater ecosystem activity and growth.

Marketing and Community

You can create a teleportation machine, but what good is it if no one knows about it? Creating a strategy that increases the reach and awareness of your product or service is essential. The greatest challenge in the crypto startup world is helping investors understand who you are, what you are building, and why it’s important. We look for innovative strategies and gauge their effectiveness. We also look for investor red flags, such as inorganic community engagement, which is often done deceptively to sway investors into believing there is greater reach and awareness than actuality.

Team and Advisors

Who are you, what have you done before, and does that make sense with your current goals? We try to understand the past experience and skills of the team and how resourceful they’ve demonstrated to be. The greatest ideas in the world will go nowhere if they are not moved forward by individuals that can operate, organize, manage, and execute.

Competitive landscape

First-mover advantage is not always a positive indicator of success. It may signify a complete lack of a target market. It may also signify a complete lack of understanding in the market of what your product or service is and why it’s important. On the other hand, understanding the adversaries in a competitive landscape will paint a picture of success by highlighting features or advantages that do not exist elsewhere and the likelihood of those gaps being closed by competitors in the company’s development and launch timeframe.

Investors, Backers, and Ecosystem Partners

“If you want to go fast, go alone, if you want to go far, go together.” Resourcefulness continues to play a theme in fundamental analysis, and you’ll see it mentioned more and more in the startup space. Every team has gaps or weaknesses. It’s important to understand how they choose to address these issues by onboarding partnerships that may allow them to save cost by white-labeling a technology or onboarding an early-round investor that can offer a connection to expedite their business development strategy.

Product, Technology, and Security

Never invest in anything you don’t understand. It’s important to have a strong grasp of what the product is and why it’s important. It’s also critical to know how it can go wrong or break. There are risks in every investment. Be sure to follow through with your own proper due diligence and risk assessment to determine how much you’re willing to lose in order to make a gain.

To learn more about our Fundamental Analysis process, and public reports for the latest cryptocurrency startups, be sure to follow us on our social media channels and pay attention for upcoming releases.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…

April 4, 2024

Arcanum Ventures is pleased to announce our latest strategic investment in Analog, a novel ‘Proof-of-Time’…