Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Token Economics Best Practices, pt. 3

Token Economics best practices are evolving just as quickly as the entire cryptocurrency industry. At Arcanum Ventures, we’re always trying to observe emerging trends and predict the direction of movement.

We’ve seen some interesting themes surface, one in particular being the slow shift toward conventional business models and corporate structures. This shift makes complete sense considering old token models resembling equity giveaways have buried their own graves.

One thing is for certain, if you’re here for a long time, you’re maybe not here for a good time (at first). It’s difficult to gain traction, market attention, and even funding, if the landscape still favors speculative and viral marketing hype. The recent bear market has been a blessing in disguise to many founders, however, that are focusing on long-term growth and product development.

We offer some more advice for this latest iteration of “Token Economics Best Practices.” This guidance is taken from strong and viable business models and is considered “generally good business practice” to entice the right money from the right investors.

Be sure to read our first article on Token Economics Best Practices part 1, for some fundamental practices to incorporate into designing your token economy.

Follow this up with Token Economics Best Practices part 2, for a bit of a deeper dive that offers some internal processes that will help ensure long term sustainability.

7. Value Accrual Mechanisms

The start of the 2021 Bull Cycle was marked by teams raising massive amounts of capital using vague and non-committal investor documentation. These business plans failed to provide enough context on how the token will be integrated into the product, and if not, how the business model will work to appreciate token value.

Mockup landing page similar to many vague token launch webpages in 2021

What resulted was investors purchasing an asset that was loosely tied to the overall company, but acted solely as a vehicle for volatile value tied closely to speculative marketing practices. One of the biggest Green Flags we look for is avoiding exactly this — positive value accrual in an ecosystem that is directly tied to increasing ecosystem activity. This may be the onboarding of new users onto your platform, or even gaining commitments for new clients and businesses in a B2B or SaaS model.

There are a number of ways to funnel value into a token economy. Some of them are more controversial and centered around securitization discussions that are still unfolding. Still, some solid strategies exist to ensure compliance, but that’s another topic we’ll dive into later.

8. Investor Checks and Balances

Lack of accountability or transparency has become commonplace in this industry. Ironically, these are two major issues blockchain evangelists hope the technology can address in financial infrastructure or logistics processes, for example.

Unfortunately, these core pillars of blockchain are not shared by every crypto player in the space. With little to no regulation, investors, founders, and service providers appear to take liberties wherever they can — oftentimes, to the detriment of business partners or clients.

Many individuals may encounter a breach of contractual obligations, failure to fulfill invoices, delayed asset distributions, and sub-par service delivery… The list goes on. Until regulatory bodies can make some progress in their game of catch-up, it’s important that every actor in this space take steps to protect themselves and others. Below are some examples and tips.

Contractual Clauses

Many contracts in this industry are flimsy at best and oftentimes unenforceable in any court of law. It’s important to drill down into specifics that tie in with deliverables and responsibilities. For example, SAFT clauses to withhold token distributions if your investor fails to deliver introductions to ecosystem partners.

On the flip side, investors gain peace of mind if a termination clause permits them to request a refund on their token purchase if your company fails to meet particular milestones. After all, that’s only fair if you decide to pivot from a DeFi protocol into a Decentralized Social Media platform after accepting funding.

Token Management

Tokens may be the unifying string between your product, investors, and community. It’s important to be responsible with how you manage them. Create visibility for your investors by locking them in Smart Contracts according to amounts and release schedules that parallel your advertised token distribution.

Be sure to use tokens specifically for the purposes you made clear to investors and be aware that any transfers made to centralized exchanges may simply appear to be off-chain and private financial transactions. A founding team that sends large tranches of tokens to a Binance hot wallet will scare investors and create grounds for difficult discussions. Many veterans in the space will see a cloaked strategy to liquidate large portions of their supply off-chain. This goes both ways.

Investor Relations

Never in the history of the financial world have we seen the possibility of small-cap investors communicating directly with company CEOs. Take advantage of this however you can. It’s important to encourage healthy discussions between your investors, especially if you encounter a hurdle they have dealt with before and can provide guidance for.

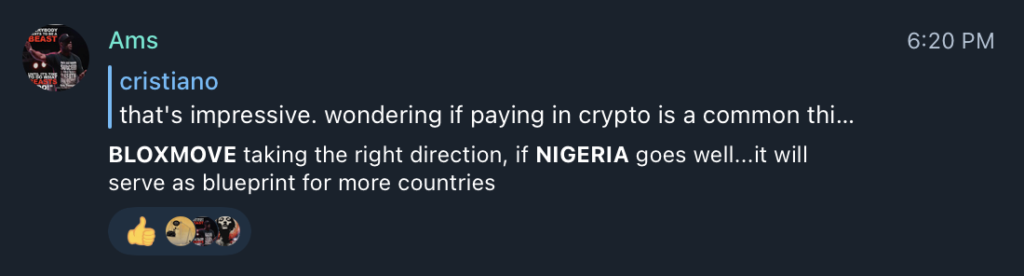

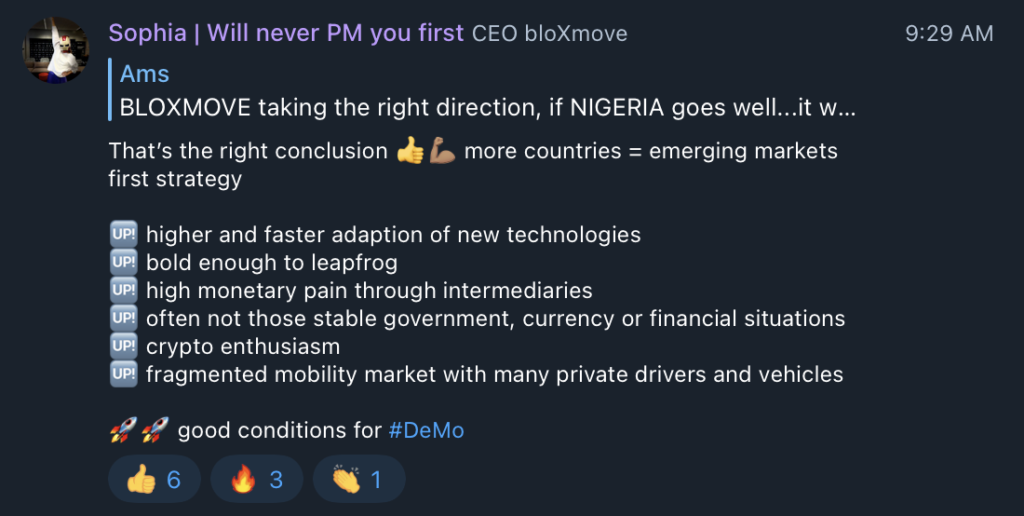

The CEO of bloXmove is consistently active in their Telegram group, chatting with community members

Keep your investors informed of development updates, financial status, networking goals, etc. Do not fear asking for help, as many investors will provide the tools you need in a greedy fashion, protecting their investment.

9. Responsible Liquidation Strategy

It’s no secret that tokens labeled as “Marketing” may ultimately be used for marketing purposes. Whether this may translate to promotional giveaways or supply liquidations for third-party services is in the eye of the token-beholder.

Early liquidations can help mitigate financial risk for your startup during a sensitive stage. It’s important to extend your runway and ensure your startup can survive speed bumps and turbulent market conditions. If your token economy and business model scale with greater user activity, it’s understood that future traction should offset any early sell pressure caused by corporate liquidations. Investors must accept the circumstances that accompany investing in technology startups with 3+ year roadmaps.

Aggressive and abrupt team liquidations commonly referred to as a “rugpull”

Still, founders should avoid heavy liquidations that can push spot sell-pressure into sustained downward momentum by causing market concerns. As a general rule of thumb, we suggest swapping out no more than 0.5% company-owned, circulating supply each month. Liquidation strategies should be guided by an internal finance professional or advisor and should align with responsible and realistic budgetary requirements.

Arcanum Can Help

We offer comprehensive token economics services and financial modeling & planning to help your startup plan for the worst.

Our goal is to give you the tools and services you need to maximize the viability and longevity of your cryptocurrency startup. We believe in backing projects that will address real issues in various industries and leverage blockchain technology to improve current systems.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

May 14, 2024

“Accessible, Transparent, Equitable”. Beyond the homepage and the navigation links, the ReformDAO whitepaper…

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…