Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Token Economics Best Practices, pt. 2

The cryptocurrency startup space is evolving every day as founders and economists test new theories, build new models, and launch new products. Token economics remains a niche yet essential part of this space as GameFi mechanics, DeFi Incentives, and Infrastructure utilities all rely on sustainable and scalable supply models.

As the frontier of the space continues to unfold, Arcanum Ventures hopes to bring you insight and understanding informed by the lessons we learn every day. Our aim is to inform founders on the nuances and best practices of structuring a cryptocurrency business model and what methodologies to follow to design your token economy.

We review many models each week, and actively work with startups to help develop revenue models and sustainable business practices. This article series will follow up on previous ones to provide any updated viewpoints we unfolding see in the space while offering new tidbits. Check out our previous article on Token Economics Best Practices part 1, in case you missed it.

4. Company Valuation – Voodoo Magic

Startup business valuations have been a topic of heated debate since the beginning of both tech and market speculation. Many consider it an art versus a science, and for good reason. Assigning a monetary value to a tech startup involves the consideration of entirely different factors compared to a traditional, publicly traded company. The former can easily be evaluated by a large handful of different metrics, many of which are tangible and sensical. These typically involve some form of analyzing cash-flows, revenue figures, the value of assets vs. liabilities, etc.

Cryptocurrency startup valuation requires a different form of fundamental analysis that can play more towards psychology. Understanding how much your startup is worth is the first stage of fundraising, even though that may just encompass the following loose assets in the very beginning stages.

- Your idea

- Your plan

- Your employees

- Your equipment (laptops and office equipment)

An accurate company valuation will better inform your token sale and the equity retained from your anticipated Fully Diluted Valuation (total market capitalization). Investor interest will undoubtedly wane on how you choose to value your company and how you choose to justify the valuation.

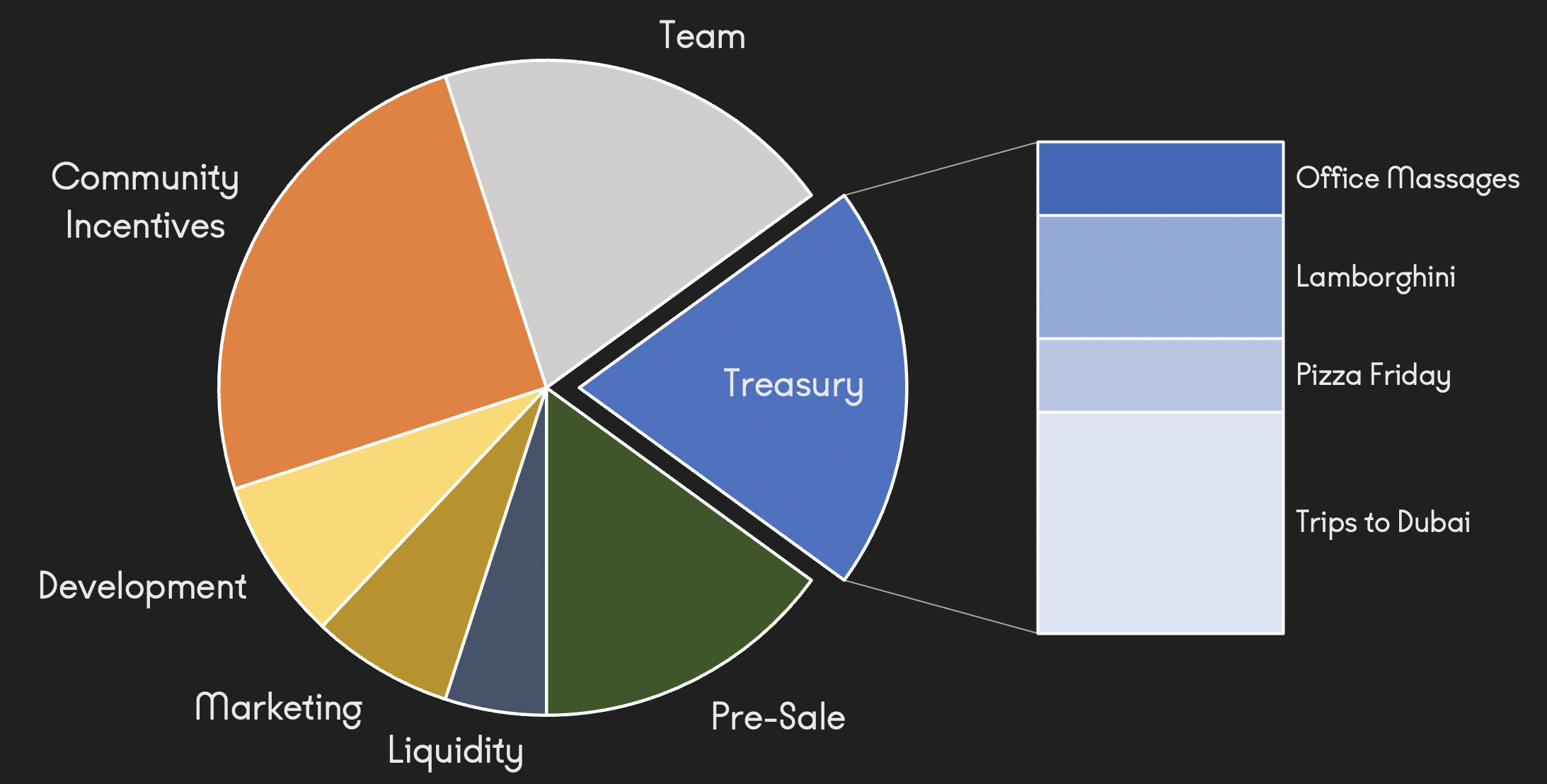

This is more easily done through the use of historical revenue figures and future projections, but it’s every founder’s fiscal responsibility to provide an accurate valuation and revenue/profit estimates. Long gone are the days of inflated valuations in the crypto-startup space as money faucets have dried up and investors wizened to the manufactured hype cycles of 2021. Be reasonable in your approach and understand that investors want to help you build your company and deliver your product – they don’t want to hand you a blank check for Friday Office Massages.

Some good rules of thumb are:

- Market conditions and investor sentiment largely dictate acceptable valuations for startups coming to market – examine those around you to understand what’s a realistic range

- History of revenue generation merits a higher valuation since it demonstrates less risk for investors

- If all else fails, do the following

- Structure your onboarding and business development strategy to achieve break-even within eighteen (18) months

- Create a realistic budget for delivering your Minimum Viable Product (MVP), and ensure this provides enough runway for the first 24 months of your budget timeline

- Add a 30% buffer and designate this amount to be your total token sale (total fundraise) valued at 25% of your total supply

- Multiply by 4 to get your new, conservative company valuation.

NOTE: This is a very generalized example using basic and current average market metrics. This is NOT applicable for every startup.

5. What do you mean Treasury?

Although the “Treasury” or “Company Reserve” tranche seemed to be quite commonplace in many token models coming to market in the past two years, this tranche remains somewhat controversial, and the usage of these tokens very unclear. With the continued lack of corporate oversight and regulations, the justification for its existence is mainly a psychological game, much like the rest of a token sale model.

Tokens held in “Treasury,” “Marketing,” or “Development” tranches can be considered operating capital, similar to funds raised from a token sale, with one main exception. These “funds” must be liquidated prior to securing this capital, meaning that they must be sold on the open market, causing sell-pressure in your token price.

It’s for this reason best practices dictate that a founding team should secure all of the funding required to develop their MVP and enter the business development phase. A bulletproof post-TGE strategy should work to gain revenue momentum and sustain the long-term viability of your company and token economy. However, it’s prudent to smartly manage your treasury and liquidate these corporate assets ethically and carefully since it will devalue your investor’s equity.

It’s considered a good business practice to ensure you can secure additional funding for your marketing program or onboarding of new developers should you need to pivot into a new product vertical. That’s exactly what these company-specific token tranches are for. The inclusion of the “Treasury” tranche, however, may give the impression that your team does not fully understand your budgetary requirements. It may also communicate the lack of tools or experience to actively and effectively manage your capital from the other internal tranches.

The mere existence of the “Treasury” tranche may give the impression of corporate greed and a “Plan Z” meant to further devalue shareholder’s equity. It’s recommended to eliminate this tranche altogether and plan your budget out as conservatively and accurately as possible. Plan for the worst, and throw in a buffer.

6. Team Tokens (a.k.a. “Foundation”)

Team or Foundation appear to be used interchangeably in token sale models and supply distributions. They refer specifically to tokens retained by the founding team itself, but there’s much more psychology here than we think.

These tokens are essentially company capital retained by the founding team with no visibility on how they will be used, but they are most often used for compensation to onboard employees. Team members are offered a portion of these tokens vested under conservative schedules to provide long-term incentive for them to perform well and work towards success.

Traditionally, Team or Foundation tokens are associated with the longest cliffs and vesting schedules. This is primarily dictated by investor sentiment since it’s understood that these tokens will go into the hands of a small number of individuals as compensation to liquidate and take profit, and not to fuel essential business functions. For this reason, too large of a supply retained by the team will appear to be “greedy” and will hurt a startup’s chances of bringing on early investors. Too small of a tranche may point to a team that chose not to incentivize work through equity, who may plan to fuel operational and labor costs through consistent revenue generation.

The appropriate sizing of this tranche has largely been dictated by market evolution, investor sentiment, the context of the product being developed, and the labor involved. Market Sentiment may dictate how easy or difficult it is for startups to secure funding. If a startup must make do with more conservative company valuations and lower fundraises, then they may be forced to provide larger portions of equity to founding and core team members.

Current popular token models coming to market size this tranche anywhere between 8% and 16%. Before choosing your Team supply amount arbitrarily, consider the following factors:

- The number of employees you must onboard to develop the product and gain market share

- Anticipated runway with these Operating and Labor costs given the current token sale model

- Amount of equity you’re willing to give employees to offset labor costs

- Value of that equity at TGE price – this helps you understand the salary you can offset

Arcanum Can Help

We offer comprehensive token economics services and financial modeling & planning to help your startup plan for the worst.

Our goal is to give you the tools and services you need to maximize the viability and longevity of your cryptocurrency startup. We believe in backing projects that will address real issues in various industries and leverage blockchain technology to improve current systems.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

May 14, 2024

“Accessible, Transparent, Equitable”. Beyond the homepage and the navigation links, the ReformDAO whitepaper…

April 16, 2024

Transparency and accountability - two principles blockchain is rooted in, and two core tenets of Arcanum…

April 11, 2024

Arcanum Ventures is proud to announce our long-term support and incubation for Qualoo and its team. Their…